April 2017 Road Tax Changes

From April 2017 new VED (Vehicle Excise Duty) charges come into force. This will affect anyone who plans on buying a new car from next month onwards.

What are the current rules?

At the moment there are 13 different categories that vehicles fall into depending on their impact on the environment. Each category or 'band' carries with it it's own charge based on this which can range from over £1000 down to free of charge depending on a cars CO2 emissions.

Who does this affect?

Anyone buying a vehicle from April 2017 onwards will be subject to these new rules. If you already own a vehicle, the new charges will not apply to you.

What are the new rules?

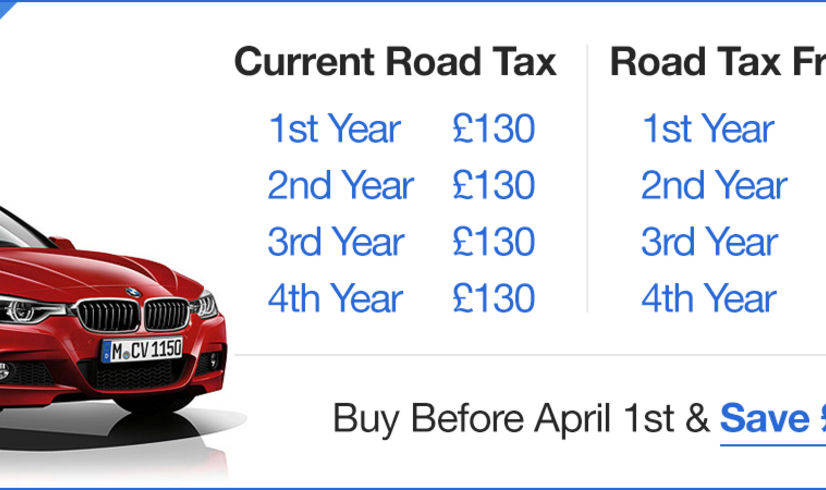

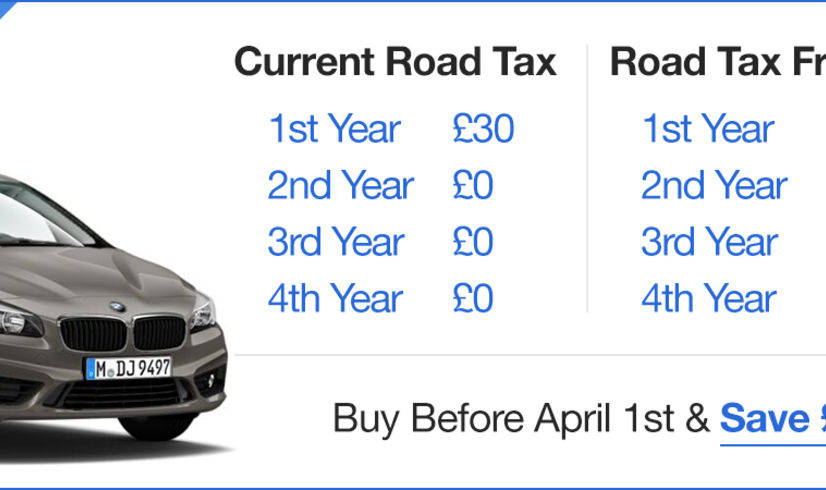

Instead of 13 categories, there are now only 3: zero emissions, standard and premium. Vehicles which fall into the zero emission category will not pay a fee for VED. Those which fall into the standard category will be charged a first year rate and will be subject to a £140 charge per year thereafter. This first year charge will depend on the environmental impact of your car based on its CO2 emission level ranging from £10 up to £2,000. To find out which charge you would be eligible for, you can find out more via the HMRC website.

In addition to this, any vehicle with a retail price of over £40,000 will be subject to a supplementary charge of £310 per year for the first 5 years of ownership.

What now?

You can visit our offer pages by clicking here where we have outlined the savings you could make by buying a vehicle now versus waiting until after the changes in VED next month.

What are the new rules?

Instead of 13 categories, there are now only 3: zero emissions, standard and premium. Vehicles which fall into the zero emission category will not pay a fee for VED. Those which fall into the standard category will be charged a first year rate and will be subject to a £140 charge per year thereafter. This first year charge will depend on the environmental impact of your car based on its CO2 emission level ranging from £10 up to £2,000. To find out which charge you would be eligible for, you can find out more via the HMRC website.

In addition to this, any vehicle with a retail price of over £40,000 will be subject to a supplementary charge of £310 per year for the first 5 years of ownership.

What now?

You can visit our offer pages by clicking here where we have outlined the savings you could make by buying a vehicle now versus waiting until after the changes in VED next month.